8 Key SaaS Customer Success Metrics & How to Measure Them

The ability for your customers to use your product successfully is key to your company's revenue growth, particularly for SaaS companies where customers often explore your product on their own, without the help of a sales demo or support from an account manager.

Successful customers are more likely to convert from a free trial, more likely to stay customers longer, and more likely to refer your product to others who need a similar solution.

The 8 most important customer success metrics

So how do you measure how successful your customers are? Below, you'll find the eight most important customer success metrics for SaaS companies, plus details on how to measure them.

1. Customer lifetime value

Customer lifetime value (CLV) represents the total value a company can expect to earn over the lifetime of a given customer relationship. As a method of measuring customer success, it’s one of the best ways to close the loop between customer success efforts and the ultimate metric — revenue.

Customer lifetime value brings together the impact your customer success operation has on two key performance indicators:

Annual revenue per customer

Average length of customer relationship (in years)

An effective customer success team should enable your business to increase both of those numbers, creating a compound impact on customer lifetime value.

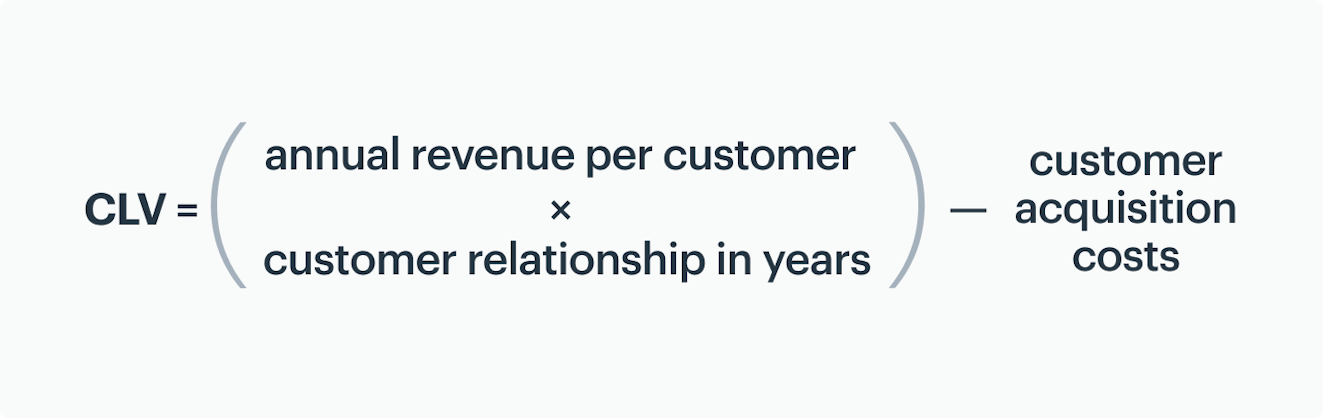

How to calculate customer lifetime value

To calculate your average customer lifetime value, you’ll need three pieces of data:

Annual revenue per customer

Customer relationship in years

Customer acquisition cost (CAC)

Once you have all the right numbers, simply multiply your annual revenue per customer by the customer relationship in years, then subtract your customer acquisition cost. The result is your average customer lifetime value.

2. Repeat purchase rate

At the end of the day, the best indicator of how successful and satisfied your customers are is whether or not they continue doing business with you. After their contract is up, do they renew? When they need to purchase your product again, do they stick with your business or defect to a competitor?

A successful customer success effort increases both the number and percentage of customers who make repeat purchases, and that’s what your repeat purchase rate (RPR) measures.

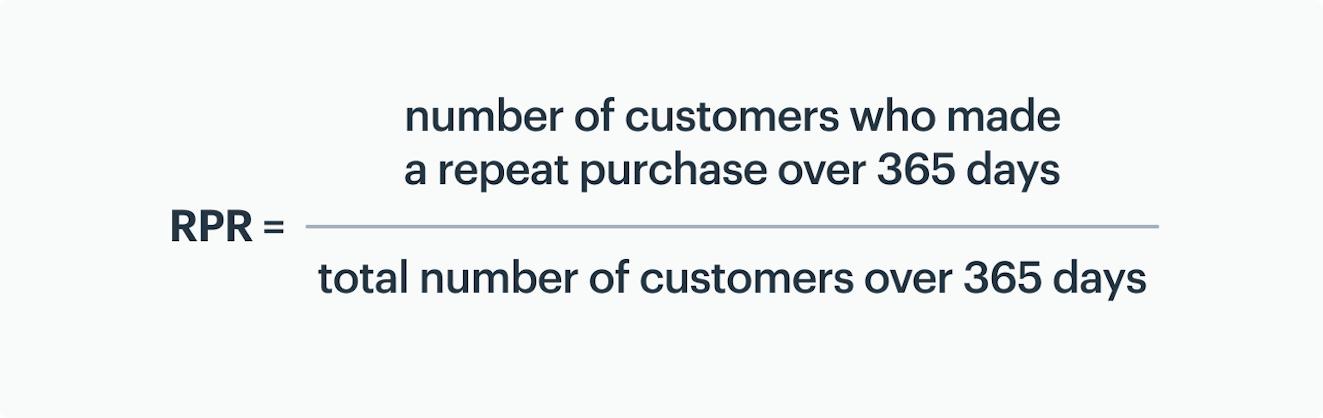

How to calculate repeat purchase rate

To calculate your repeat purchase rate, you’ll need two numbers on hand:

The number of customers who made a repeat purchase over a given period of time

Your total number of customers over the same time period

Those numbers, along with repeat purchase rate, are typically calculated based on annual numbers — but you can measure them based on any given time period that makes sense for your business.

Once you have your data handy, simply divide the number of customers who made a repeat purchase by the total number of customers for your chosen time period.

3. Customer retention rate

Customer retention rate (CRR) is similar to repeat purchase rate, but it’s the more applicable option for companies with more ongoing customer relationships (vs. one-off, transactional ones).

Your customer retention rate measures the percentage of existing customers your business retained over a given period. In other words, from one month, quarter, or year to the next, how many of your customers stick around?

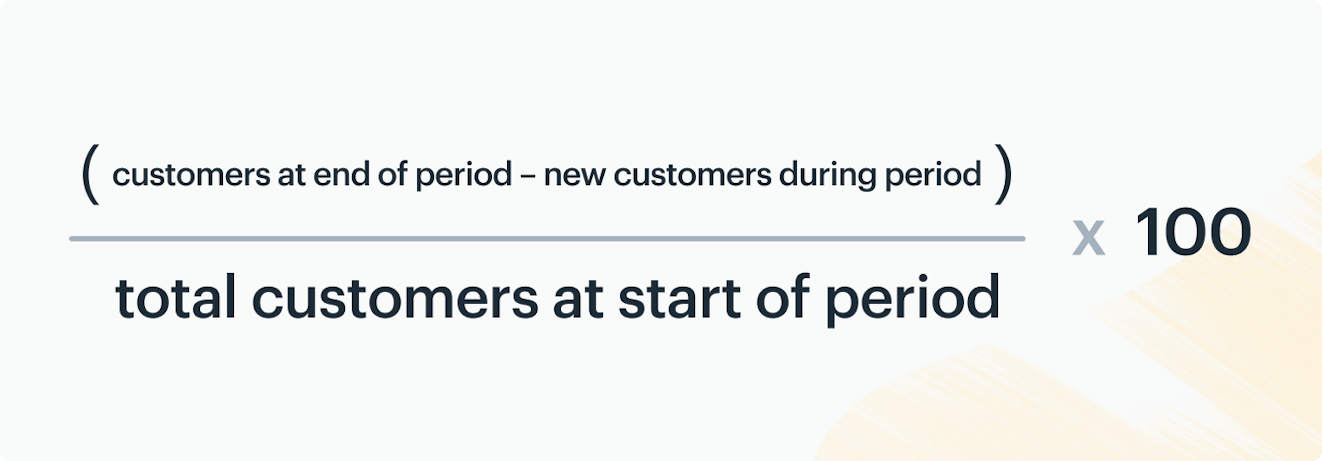

How to calculate customer retention rate

To calculate customer retention rate, you’ll need to know three pieces of information:

The number of customers you had at the beginning of a given period of time

The number of customers you had at the end of that period

The number of new customers you acquired during that period

From there, you’ll subtract the number of newly acquired customers from your total customers at the end of the time period, then divide that number by the number of customers you had at the beginning. Multiply your answer by 100 to get the percentage that is your customer retention rate.

4. Customer retention cost

Along the same vein, customer retention cost (CRC) measures the financial investment required for your business to retain each customer. Measuring this customer success metric is useful in a few ways:

Measuring the impact of customer success and related efforts on customer retention — effective customer success teams grow customer retention in greater proportion than the costs of their operation.

Allowing you to gauge whether your customer lifetime value justifies the investment you make in customer success and retention.

Effectively, CRC tells you whether or not your customer success efforts are yielding returns.

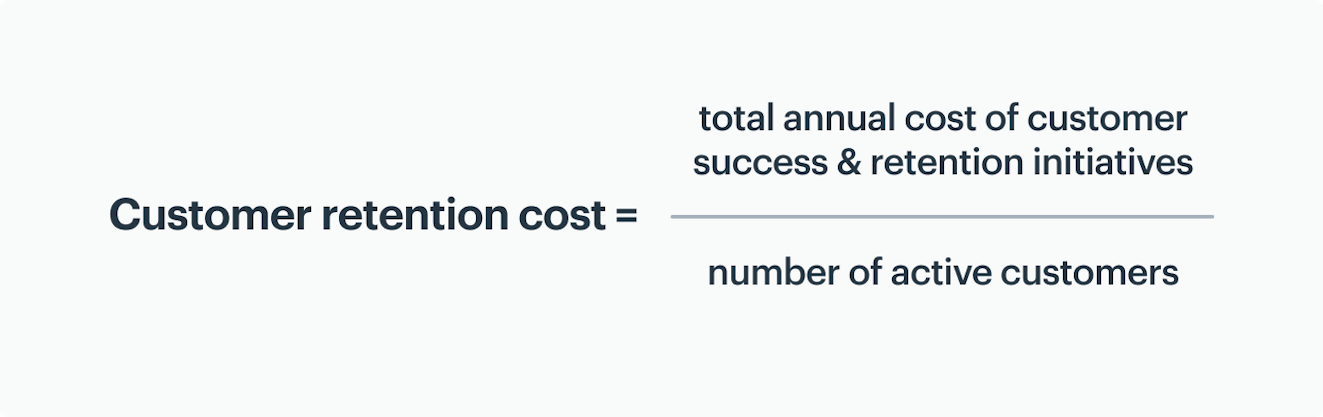

How to calculate customer retention cost

To calculate customer retention cost, you’ll need two pieces of data:

The total annual cost of your customer success and retention teams and initiatives

The number of current active customers

Once you have those numbers ready, just divide the total annual cost by the number of active customers. The answer (in dollars) is your customer retention cost.

5. Churn rate

Measuring your churn rate is essentially looking at retention from a different point of view. Instead of customers retained, churn measures how many customers you lose over a given time period (usually a month).

There are a lot of ways to measure churn — you can make this metric as simple or as complicated as your needs require. But primarily, churn is measured as either the number of customers lost or the dollar value lost that those customers represent.

While that sounds simple enough, measuring churn in a useful way requires a specific and rigid way to define what a “lost” customer looks like — and that will vary from business to business.

For more details on how to define churn for your business, check out ProfitWell’s blog post.

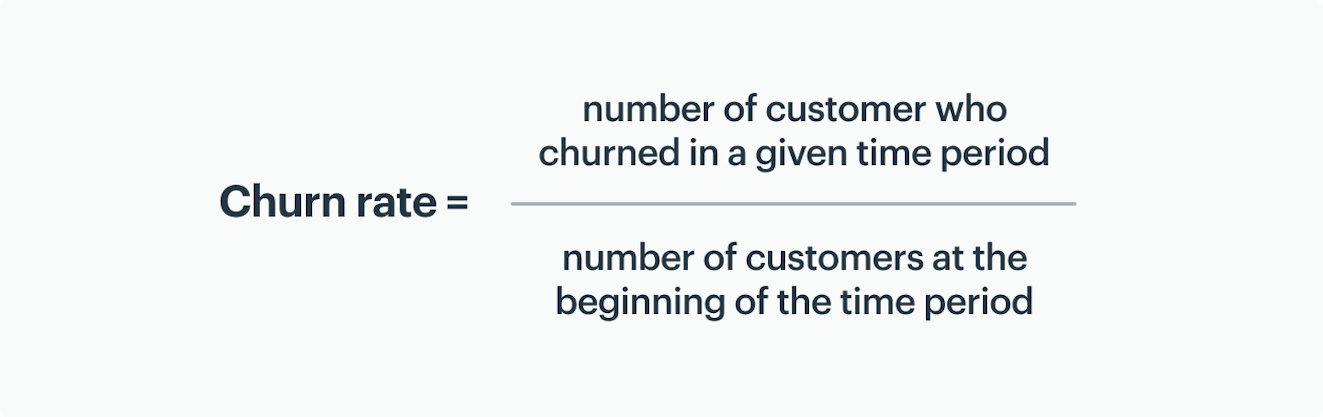

How to calculate churn rate

Once you’ve defined a churned customer, the basic formula for churn rate really is quick and easy. You’ll need to know:

How many customers you had at the beginning of the time period (again, this is usually a monthly calculation)

How many customers churned during the same period

From there, divide the number of customers who churned by your beginning number, then multiply by 100. The result is your churn rate.

6. Net Promoter Score

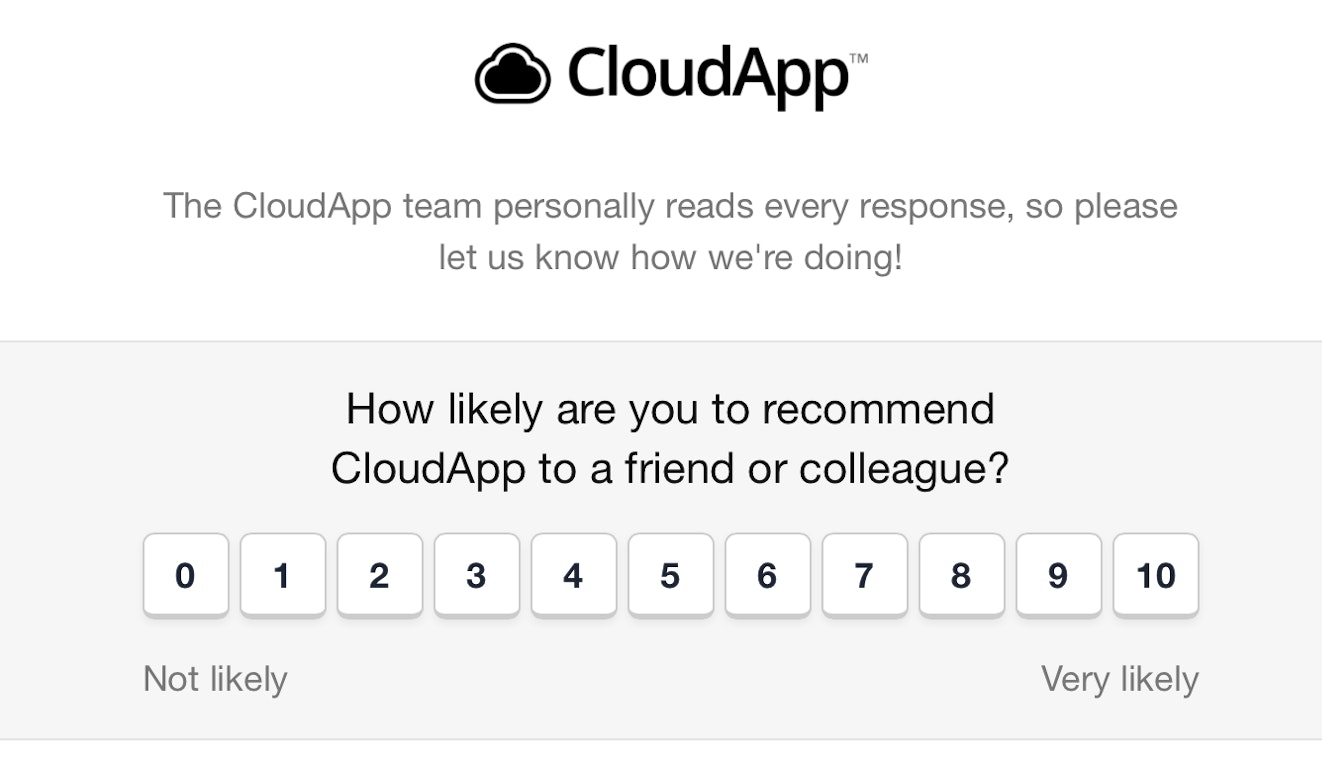

Net Promoter Score (NPS) is fundamentally different from the previous customer success metrics we’ve talked about. That’s because it relies on direct customer feedback and voice of customer data.

NPS has grown substantially in popularity in recent years, so if you haven’t used it as a customer success professional, you’ve likely experienced it as a consumer.

Your Net Promoter Score is a metric based on customer responses to an NPS survey. The survey consists of one question posed alongside a 10-point scale: “How likely are you to recommend (business or product) to a friend?”

Customers who respond with a number between 0 and 6 are called “detractors.”

Those who respond with 7 or 8 are “passives.”

Respondents who choose 9 or 10 are your “promoters.”

How to calculate Net Promoter Score

Net Promoter Scores vary between -100 and +100. Once you’ve conducted an NPS survey of your customers, it’s a very easy calculation: Your NPS is the difference between the percentage of promoters and the percentage of detractors.

NPS = % Promoters – % Detractors

Note: NPS metrics are expressed as a number, not a percentage.

7. Customer Satisfaction Score

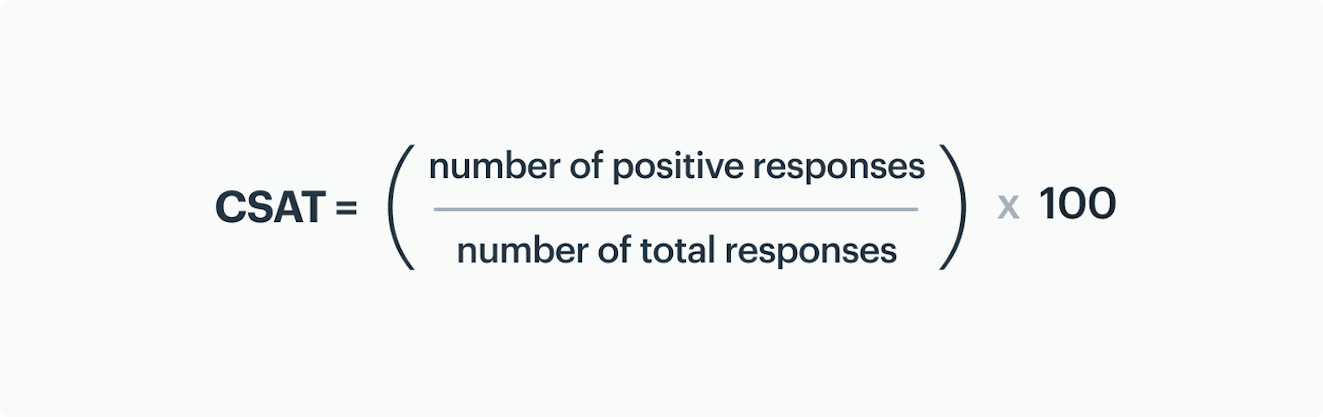

Customer satisfaction score (CSAT) is similar to NPS in that it's based on real customer feedback instead of internal company data. This metric, however, is much more flexible and varied than NPS.

Your customer satisfaction score is measured based on how customers rate their experience with your company. Beyond that, you have a lot of options in terms of the specific question you pose to customers, the rating scale you implement, and more.

How to calculate CSAT

The first step in calculating your customer satisfaction score is to design your CSAT survey. Start by deciding on the question you want to ask customers. Common CSAT questions include:

“How satisfied are you with the help you received?”

“Did you find everything you were looking for?”

Once you choose a question, think about the kind of rating scale that would be most helpful to your team. Many businesses opt for a simple good/bad rating system. On the other end of the spectrum, you can offer anywhere up to a 7-point scale. For our part, we recommend at least offering a neutral option to customers, to avoid skewing your data.

From there, your CSAT formula is the number of positive responses divided by the total number of responses, then multiplied by 100 to get a percentage.

8. Customer Effort Score

Among the newer customer success metrics to gain popularity, Customer Effort Score (CES) follows from the idea that the more effort your service or product requires from customers, the less likely they are to stick around.

That concept has plenty of data to back it up. Researchers found that a whopping 94% of customers who rated interactions as “low effort” repurchased in the future. And HubSpot found that, of the customers reporting “high effort” interaction, up to 81% may speak negatively about the company.

All of that is to say that measuring customer effort is a key component of gauging your customer success performance. It adds vital context that CSAT and NPS surveys can miss.

How to calculate Customer Effort Score

Customer Effort Scores are typically based on a one-question survey that's similar to NPS and CSAT. The Customer Effort Score question asks customers to rate their level of agreement with a certain statement regarding their experience. Often, it looks like some variation of: “(Company) made it easy to handle my issue,” with a rating scale of 1-7.

To calculate your Customer Effort Score, simply find the average of all customer ratings (it will be a number between 1 and 7).

Keep a pulse on your customer success metrics

The customer success metrics we’ve highlighted here are a great place to start measuring how successful your customers are able to be with your product.

That said, the metrics mark only the beginning — the numbers represent indicators to help you uncover areas for more in-depth research and measurement. From there, you can gather more details and qualitative responses from customers and use those to supercharge customer success.